|

Cash App ★ 4.6 |

|---|---|

| ⚙️Developer | Block, Inc. |

| ⬇️Downloads | 50,000,000+ |

| 📊Category | Finance |

| 🤖Tags | cash | banking | app |

Cash App has emerged as one of the leading mobile payment platforms, transforming the way people send, receive, and manage money. With its user-friendly interface and a wide range of features, Cash App has become an essential tool for individuals, businesses, and even freelancers. Whether you’re splitting bills with friends, paying for goods and services, or managing your finances, Cash App simplifies the process, making transactions quick, secure, and hassle-free.

Features & Benefits

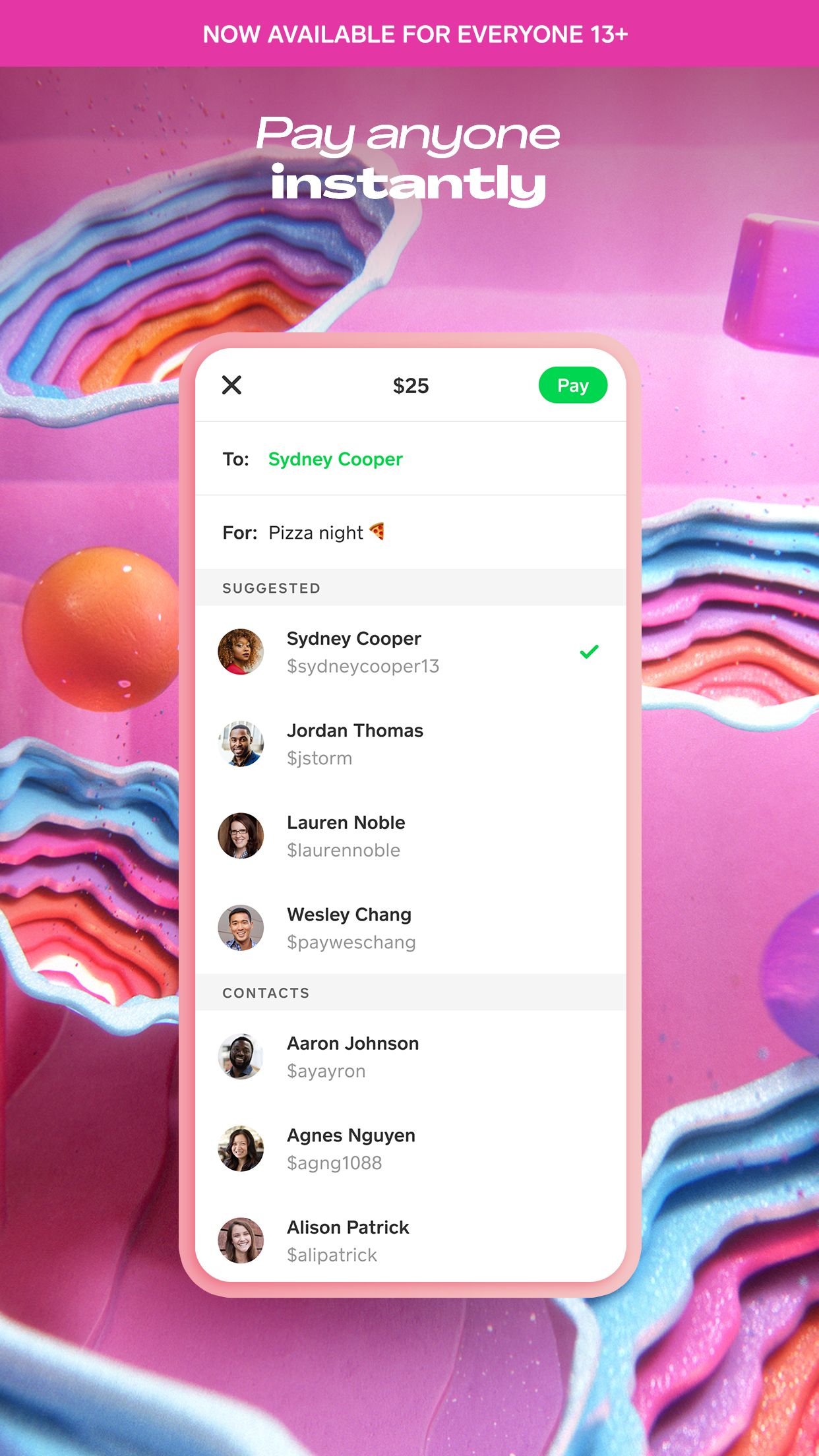

- Send and Receive Money: Cash App allows you to send and receive money instantly with just a few taps on your smartphone. Whether you’re paying back a friend or receiving payment for a service, the app makes it easy to transfer funds securely and quickly.

- Cash Card: Cash App offers a physical debit card, known as the Cash Card, which is linked to your Cash App account. With this card, you can make purchases at any retail location or withdraw cash from ATMs. The Cash Card provides a seamless connection between your digital and physical transactions.

- Bitcoin Trading: Cash App has integrated Bitcoin trading, allowing users to buy, sell, and hold cryptocurrency directly within the app. This feature provides a convenient way to enter the world of digital currencies and take advantage of the potential investment opportunities they offer.

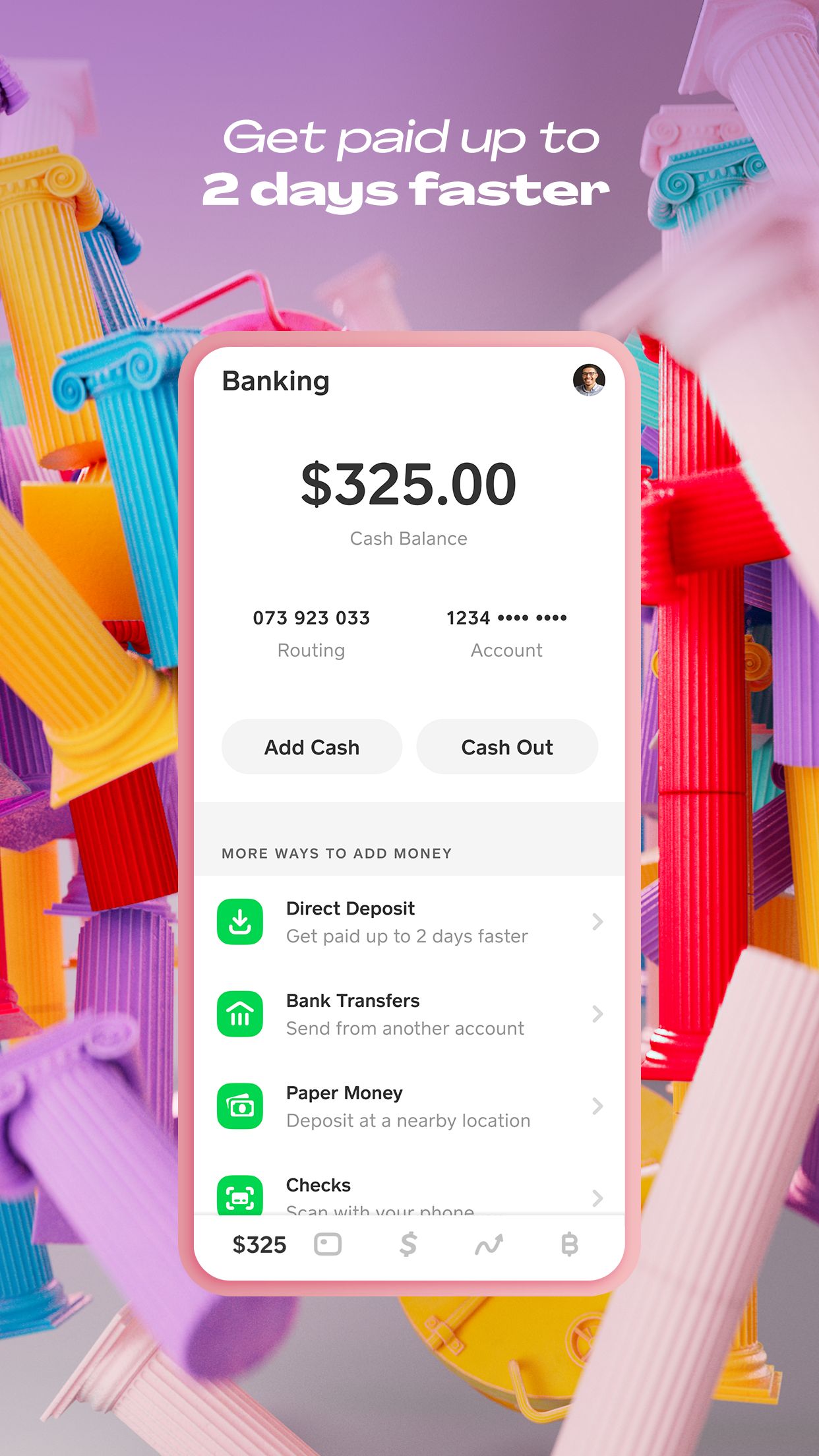

- Direct Deposit: Cash App allows users to set up direct deposit, enabling them to receive their paychecks directly into their Cash App account. This feature eliminates the need for traditional banking services and provides a fast and convenient way to access funds.

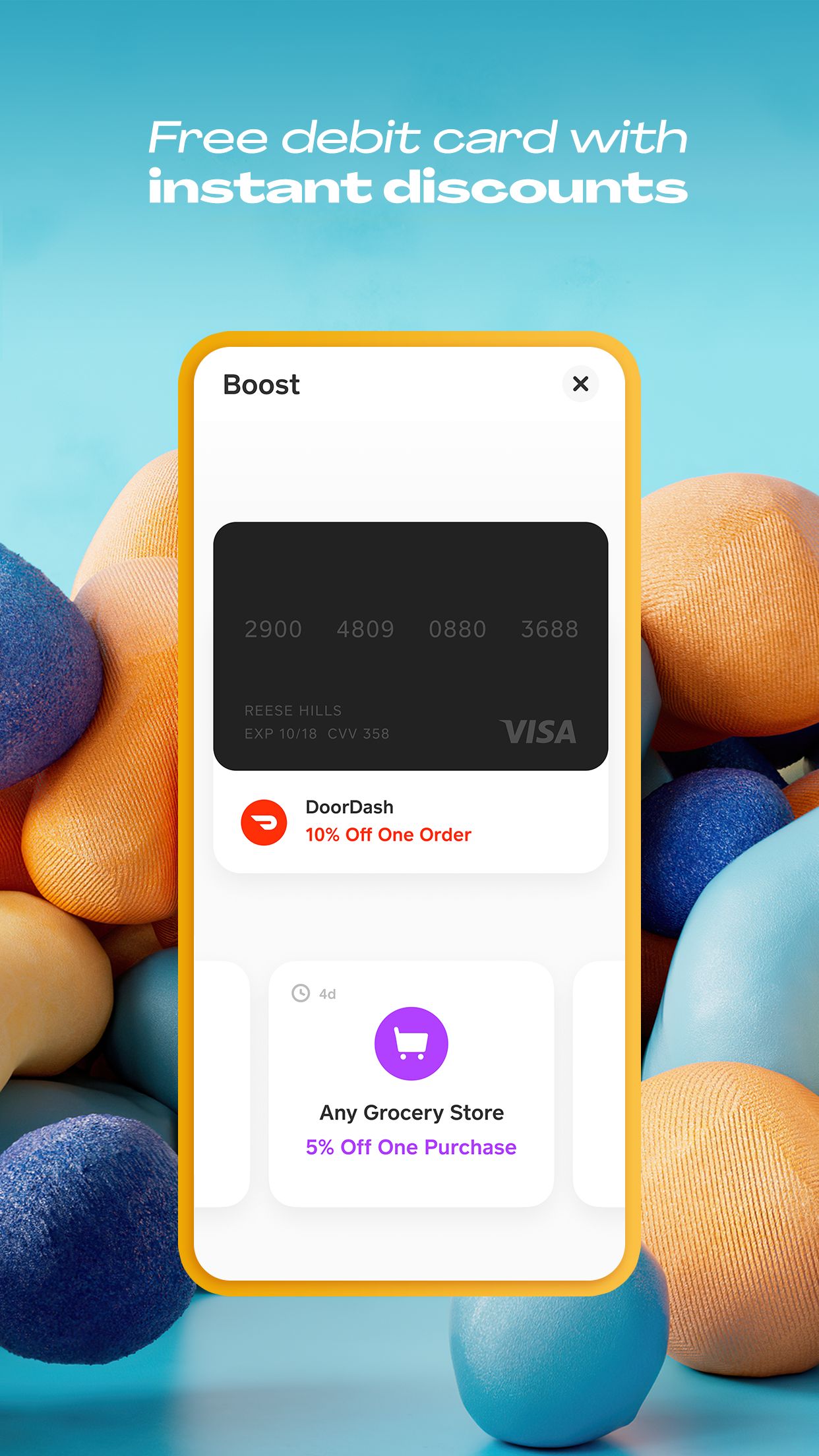

- Cash Boost: Cash App offers Cash Boost, which provides instant discounts when you use your Cash Card at select retailers. This feature allows you to save money on everyday purchases, such as groceries, coffee, or dining out.

Pros & Cons

Cash App Faqs

If your payment on Cash App is pending, it could be due to a variety of reasons such as network issues or problems with the recipient’s account. To address this, first, check your internet connection and ensure that you are logged into your Cash App account. If the problem persists, reach out to the recipient to confirm their Cash App status. If everything seems fine on their end, the payment may still be processing, and you can wait a little longer. If the payment remains pending for more than 24 hours, consider contacting Cash App support for assistance. Once a payment has been sent through Cash App, it generally cannot be canceled if it¡¯s marked as completed. However, if the payment is still pending, you may have the option to cancel it. To attempt a cancellation, open the app, navigate to the Activity tab, find the payment in question, and look for an option to cancel. If the recipient hasn¡¯t accepted the payment yet, it will show as pending, allowing for a cancellation. In cases where the payment has already been completed, you can request a refund directly from the recipient. To increase your Cash App limit, you need to verify your identity within the app. This typically involves providing your full name, date of birth, and the last four digits of your Social Security number. Once you¡¯ve completed the verification process, your sending limit may increase significantly. Keep in mind that there are different limits for sending and receiving funds, and fully verifying your account helps unlock higher limits. A payment decline on Cash App can happen for several reasons, including insufficient funds in your account, a restriction on the recipient’s account, or issues related to the linked bank account or debit card. Double-check your balance before initiating a transaction and ensure the recipient’s account is active. If you’re consistently facing declines, review your account settings and consider contacting Cash App support for further clarification. If you forget your Cash App PIN, you can reset it by following these steps: Open the app, go to the profile icon, scroll to the “Privacy & Security” section, and select ¡°Change PIN.¡± You¡¯ll then be prompted to enter your email address or phone number associated with your account to receive a reset link or code. Follow the instructions provided to create a new PIN. Make sure to choose a memorable PIN for easier access in the future. Cash App employs various security measures to protect users, including encryption and fraud detection technology. However, it’s essential for users to exercise caution while using the app. Always verify the recipient¡¯s details before sending money and avoid sharing personal information or your Cash App login credentials. Be wary of scams, especially unsolicited requests for payments. For additional safety, enable two-factor authentication in the app’s settings. To dispute a transaction, open your Cash App and navigate to the Activity tab where you can see your transaction history. Find the transaction you wish to dispute and tap on it for more details. There should be an option labeled ¡°¡¡± or ¡°Report¡± to initiate the dispute process. Follow the prompts to explain the reason for the dispute, and submit your report. Cash App will investigate the claim and inform you of the outcome. If you mistakenly send money to the wrong person, your best course of action is to contact the recipient immediately, requesting them to return the funds. If they refuse, you can utilize the app’s “Request” feature to ask for the money back. If the situation doesn’t resolve, consider reporting the issue to Cash App support, although recovery isn’t guaranteed since all transactions are considered final once completed. Always double-check payment details before confirming transactions to minimize such risks.What should I do if my Cash App payment is pending?

Can I cancel a Cash App payment once it’s sent?

How can I increase my Cash App limit?

Why did I receive a Cash App payment decline message?

What should I do if I forgot my Cash App PIN?

Is Cash App safe to use for transactions?

How can I dispute a transaction on Cash App?

What happens if I accidentally send money to the wrong person on Cash App?

Alternative Apps

- Venmo: Venmo is a popular peer-to-peer payment app that allows users to send and receive money easily. Similar to Cash App, Venmo offers a social aspect where users can like and comment on transactions. While Venmo does not offer features like the Cash Card or Bitcoin trading, it remains a convenient and widely used app for quick money transfers.

- PayPal: PayPal is a well-established online payment platform that offers a range of services, including person-to-person money transfers, online shopping payments, and merchant solutions. Like Cash App, PayPal allows users to send and receive money instantly, and it also offers a physical debit card for offline purchases. PayPal’s extensive network and global availability make it a strong competitor to Cash App.

-

Zelle: Zelle is a digital payments platform that enables users to send money directly from their bank accounts to other individuals. It offers fast and secure transfers, similar to Cash App, but without the need for a separate app or account. Zelle is often integrated into banking apps, making it a convenient option for individuals who prefer to use their existing banking services for money transfers.

Screenshots

|

|

|

|