|

Direct Express Mobile ★ 4.5 |

|---|---|

| ⚙️Developer | Comerica Bank |

| ⬇️Downloads | 1,000,000+ |

| 📊Category | Finance |

| 🤖Tags | mastercard | express | prepaid |

The Direct Express Mobile App is a convenient and secure way for recipients of federal benefits to manage their funds. Designed specifically for individuals who receive Social Security, Supplemental Security Income (SSI), or other federal benefits, the app provides access to account information, transaction history, and various financial management features. With the Direct Express Mobile App, users can conveniently and securely manage their benefits on the go.

The app is backed by the Direct Express Debit Mastercard program, which provides a safe and reliable way for individuals to receive their federal benefits electronically. With the mobile app, users can easily access their account information, track transactions, set up alerts, and manage their funds, all from the convenience of their smartphone.

Features & Benefits

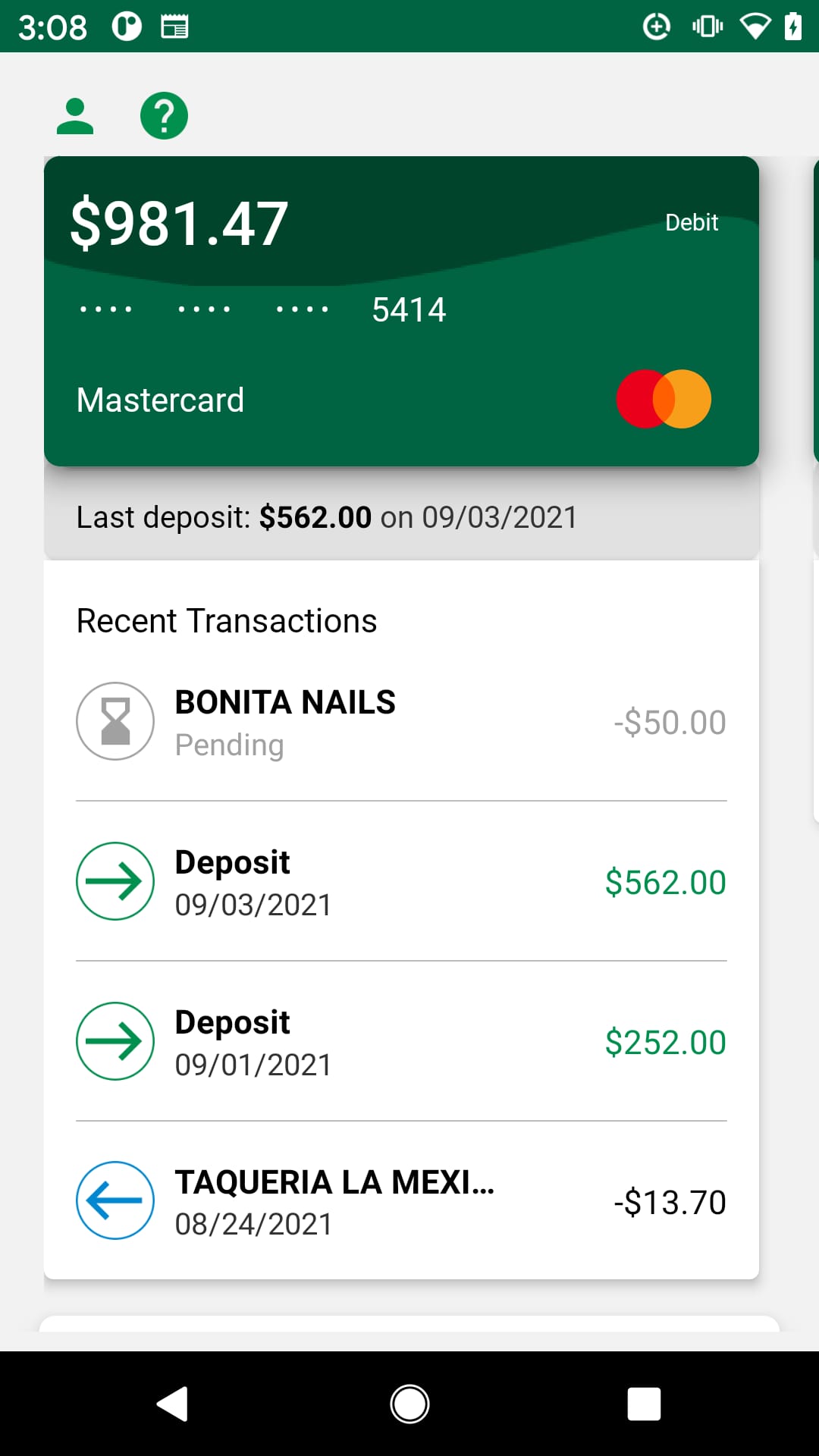

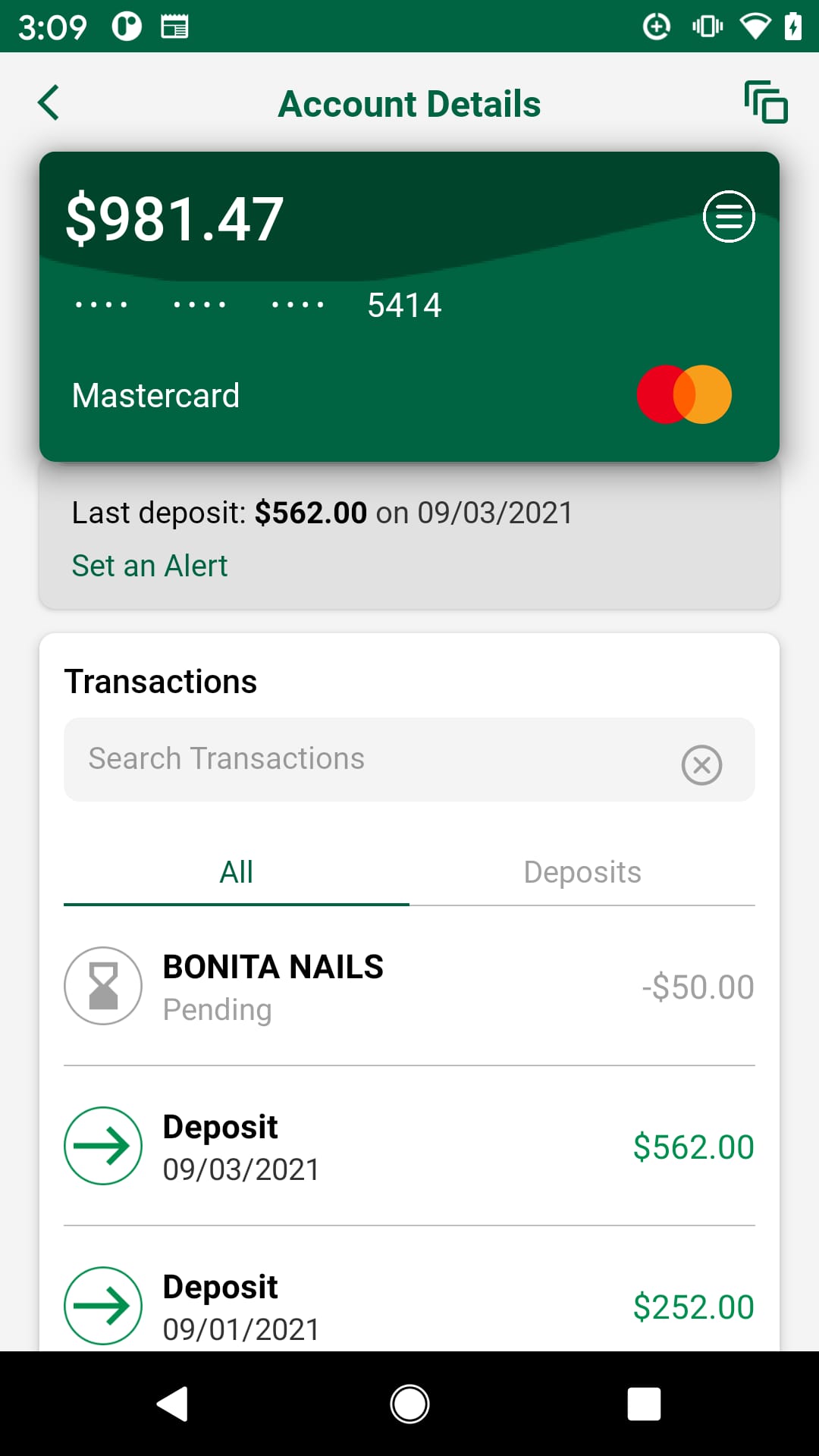

- Account Management: The Direct Express Mobile App allows users to access their account information quickly and conveniently. Users can view their current balance, transaction history, and pending deposits or withdrawals. This feature provides users with real-time visibility into their funds and helps them track their spending.

- Transaction Monitoring: The app enables users to monitor their transactions and detect any unauthorized activity. Users can receive alerts for transactions, deposits, or withdrawals, helping them stay informed about their account activity and identify any potential issues promptly.

- ATM Locator: The app provides an ATM locator feature, allowing users to find the nearest Direct Express surcharge-free ATM. This feature is particularly beneficial for users who prefer to withdraw cash or check their balance at an ATM rather than making purchases with their card.

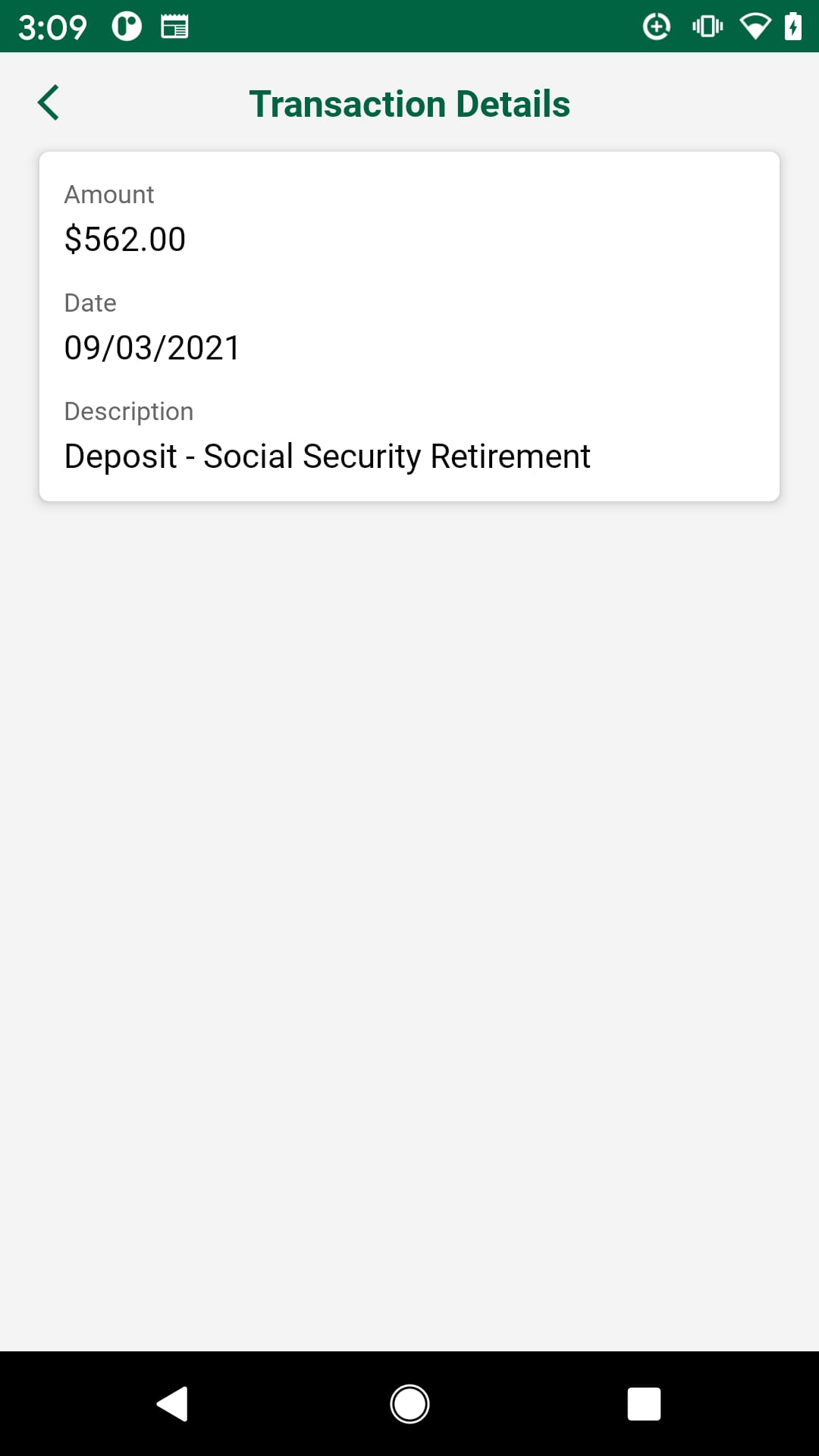

- Benefit Payments: With the Direct Express Mobile App, users can conveniently access their benefit payments. Funds are automatically deposited into the user’s Direct Express account, eliminating the need for paper checks or visits to a bank. Users can review their payment history and track the arrival of their benefits.

- Customer Support: The app offers access to customer support services, including a toll-free helpline, FAQs, and a secure messaging feature. Users can get assistance with account-related inquiries, report lost or stolen cards, and address any concerns they may have about their benefits.

Pros & Cons

Direct Express Mobile Faqs

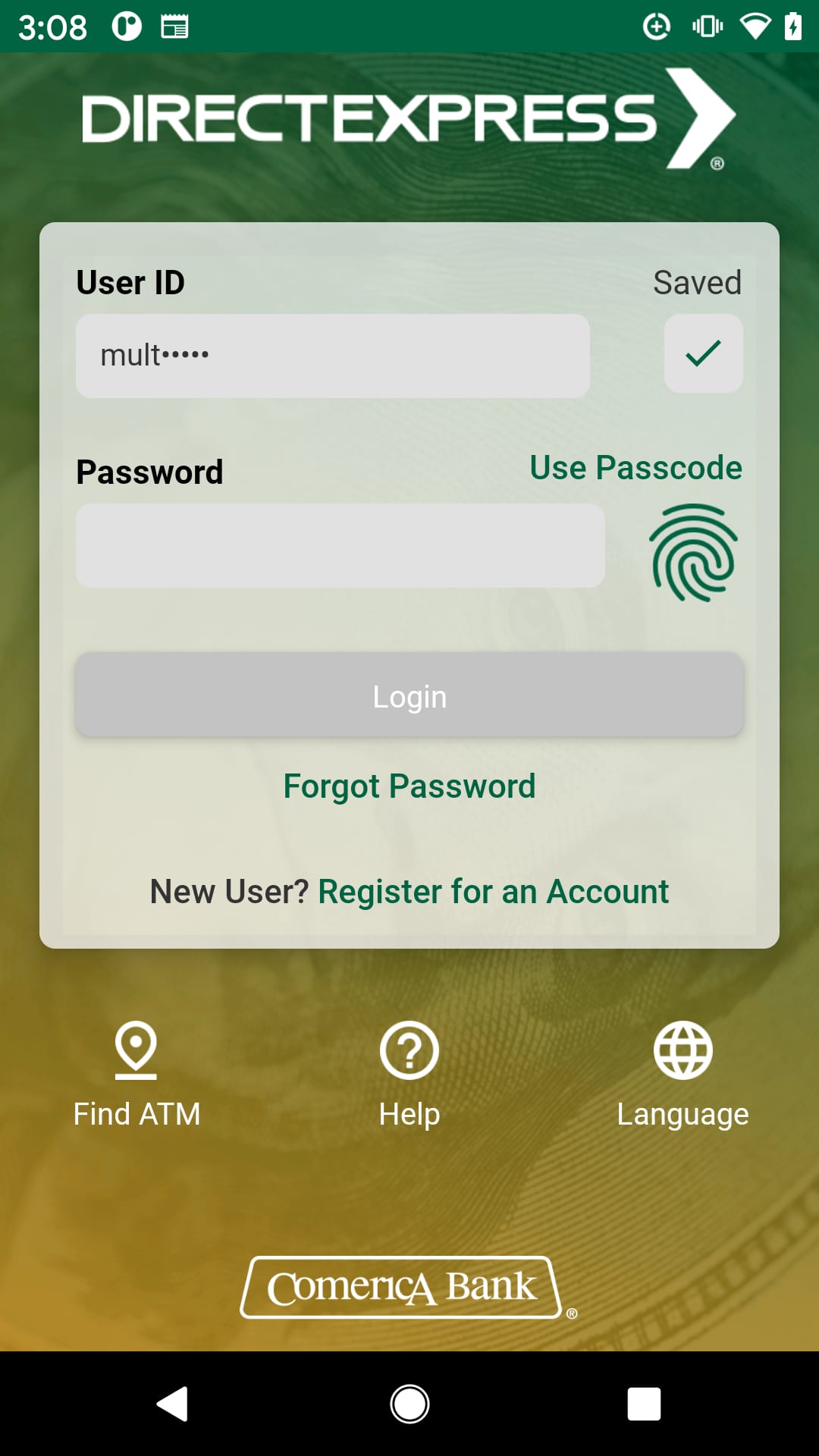

To check your balance in the Direct Express Mobile app, log in to your account with your username and password. Once you’re on the home screen, you will see your current balance displayed prominently. If you want more detailed transactions, navigate to the ¡°Transaction History¡± section where you can view past deposits and expenditures. Yes, the Direct Express Mobile app provides an option to enable notifications. You can set up alerts for various activities including when a deposit is made to your account or when a transaction exceeds a certain amount. To modify your notification settings, go to the ¡°Settings¡± menu within the app and select ¡°Notifications¡± to customize your preferences. While you cannot initiate a dispute directly through the Direct Express Mobile app, you can easily access your transaction history and identify any discrepancies. For disputing a transaction, you should contact customer service directly via the phone number provided in the app. They will guide you through the process of resolving any issues. If you forget your password, simply click on the ¡°Forgot Password?¡± link on the login page of the Direct Express Mobile app. You will be prompted to enter your registered email address or phone number. Follow the instructions sent to you, which may include a verification code, to reset your password and regain access to your account. The Direct Express Mobile app does not support direct transfers to external bank accounts. However, you can use the app to manage your funds effectively and access your card details if you wish to withdraw cash from ATMs or make purchases. For transferring funds, other services or methods might be required. Yes, the Direct Express Mobile app employs advanced security measures, including encryption and multi-factor authentication, to protect your personal and financial information. Always ensure that you download the app from official sources, keep your device updated, and avoid sharing your login credentials to maintain your account¡¯s security. To update your personal information, such as your address or phone number, log into the Direct Express Mobile app and navigate to the ¡°Profile¡± section. Here, you will find options to edit your personal details. After making the necessary changes, ensure to save them for them to take effect. If the Direct Express Mobile app crashes or fails to load, try closing the app completely and restarting it. If the problem persists, check for any available updates in your device’s app store and install them. Additionally, ensure that your internet connection is stable. If issues continue, consider uninstalling and reinstalling the app, or reach out to customer support for assistance.How do I check my balance using the Direct Express Mobile app?

Can I receive notifications for transactions through the app?

Is there a way to dispute transactions directly within the app?

What should I do if I forget my password for the Direct Express app?

Can I transfer money to another bank account using the Direct Express app?

Is the Direct Express Mobile app secure?

How can I update my personal information in the app?

What should I do if the app crashes or fails to load?

Alternative Apps

- Chime: Chime is a mobile banking app that provides users with a range of features similar to the Direct Express Mobile App. It offers a spending account, a Visa debit card, and access to direct deposits. Users can manage their accounts, track transactions, and set up alerts for account activity. Chime also provides a fee-free ATM network and offers cashback rewards on certain purchases.

- Bluebird by American Express: Bluebird is a prepaid debit card and mobile app that offers features tailored for individuals looking for an alternative to traditional banking. Users can load funds onto their Bluebird card, manage their account through the app, and access features such as bill pay, mobile check deposit, and budgeting tools. The app also provides access to customer support services.

- Capital One Mobile: Capital One Mobile is a comprehensive banking app that allows users to manage their accounts, track transactions, and make payments. In addition to basic account management features, the app offers budgeting tools, spending insights, and personalized alerts. Users can also securely lock their debit card if it’s misplaced and unlock it when found.

These three apps provide similar functionalities to the Direct Express Mobile App, offering users the convenience of managing their funds and accessing financial services from their smartphones. Each app has its own unique features and benefits, catering to different user preferences and needs.

Screenshots

|

|

|

|