|

Truist Mobile ★ 4.7 |

|---|---|

| ⚙️Developer | Truist Financial Corporation |

| ⬇️Downloads | 1,000,000+ |

| 📊Category | Finance |

| 🤖Tags | banking | mobilelooking | bank |

The Truist Mobile App revolutionizes the way you manage your finances, putting the power of banking right at your fingertips. Truist, one of the largest financial institutions in the United States, has developed this comprehensive mobile app to provide its customers with a seamless and convenient banking experience. With its user-friendly interface and robust features, the Truist Mobile App allows you to take control of your finances anytime, anywhere.

Gone are the days of visiting a physical bank branch or waiting in long queues. With the Truist Mobile App, you can access a wide range of banking services, from checking your account balances and making transfers to paying bills and managing your investments. Whether you’re on the go or relaxing at home, the Truist Mobile App empowers you to stay connected to your financial world with ease and security.

Features & Benefits

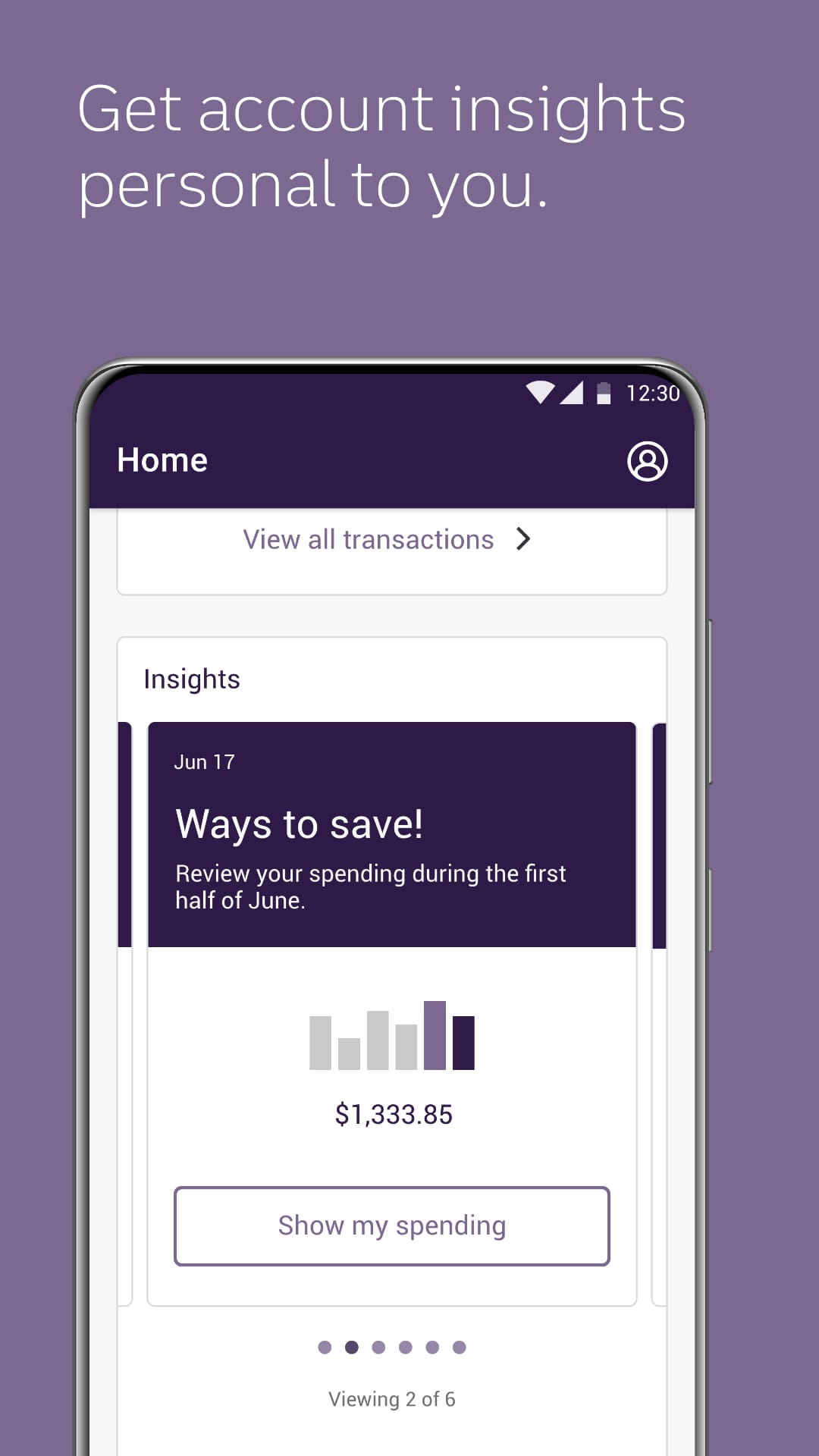

- Account Management: The Truist Mobile App provides a comprehensive suite of account management features. You can view your account balances, transaction history, and eStatements in real-time, allowing you to stay up to date with your finances. The app also enables you to easily transfer funds between accounts, set up automatic bill payments, and track your spending.

- Mobile Deposits: Say goodbye to the hassle of visiting a branch or ATM to deposit a check. With the Truist Mobile App, you can simply take a photo of your check and submit it for deposit. This feature saves you time and effort, allowing you to deposit checks conveniently from anywhere, anytime.

- Card Controls and Alerts: The app offers robust card controls and alerts functionality, providing an extra layer of security and control over your debit and credit cards. You can activate and deactivate your cards, set spending limits, and receive real-time notifications for card transactions, ensuring that you have full visibility and control over your card activity.

- Bill Pay and Transfers: The Truist Mobile App streamlines your bill payment process. You can easily set up one-time or recurring payments, schedule transfers between your accounts, and even send money to friends and family using Zelle. The app ensures that your payments are processed securely and promptly, saving you time and eliminating the need for paper checks.

- Investment and Wealth Management: Truist’s commitment to providing a comprehensive banking experience extends to investment and wealth management. With the Truist Mobile App, you can access your investment accounts, track market performance, and make informed investment decisions on the go. The app also offers personalized insights and financial planning tools to help you achieve your financial goals.

Pros & Cons

Truist Mobile Faqs

To reset your password in the Truist Mobile app, open the app and select the ¡°Log In¡± option. Below the password field, tap on ¡°Forgot Password?¡± Follow the prompts to enter your registered email address or phone number. You will then receive a link via email or SMS to create a new password. Make sure to choose a strong password that meets the security requirements outlined in the instructions. Yes, you can make mobile deposits through the Truist Mobile app. To do so, log into your account and navigate to the “Deposit” section. Select ¡°Mobile Deposit,¡± then choose the account into which you’d like to deposit funds. Follow the prompts to take photos of both the front and back of your endorsed check. Ensure that the check is clearly visible and within the frame before submitting. Once submitted, you¡¯ll receive a confirmation notification regarding the status of your deposit. Yes, the Truist Mobile app does impose limits on mobile deposits. Generally, the daily limit for mobile deposits is $2,500, while the monthly limit can be up to $5,000, depending on your account type and history. These limits may vary, so it’s advisable to check your specific account details or contact customer support if you have questions about your deposit limits. To enable biometric login (such as fingerprint or face recognition), log into the Truist Mobile app and go to the “Settings” section. Look for the ¡°Security¡± options, where you should find an option to enable biometrics. Toggle this feature on, and follow any additional prompts to authenticate your identity. Once enabled, you can use your biometric data to log in quickly and securely without entering your password each time. If you’re having trouble logging into the Truist Mobile app, first ensure that you are entering the correct username and password. If you’ve forgotten your password, utilize the ¡°Forgot Password?¡± feature to reset it. If you continue to experience issues, try updating the app to the latest version or clearing the app’s cache from your device settings. If problems persist, it¡¯s best to contact Truist customer service for further assistance. To view your transaction history, log into the Truist Mobile app and navigate to the ¡°Accounts¡± section. Select the specific account you wish to review, and you will see a list of recent transactions. You can filter transactions by date or category to find specific entries more easily. For a more detailed view, tap on individual transactions to see their descriptions and any associated notes. Yes, you can transfer money between accounts using the Truist Mobile app. Log in, go to the ¡°Transfers¡± section, and select ¡°Between Accounts.¡± Choose the accounts involved in the transfer, specify the amount, and set the date for the transaction. Review the details to confirm accuracy, then submit your transfer request. You will receive a notification confirming the successful completion of the transfer. You can access your credit score through the Truist Mobile app if you have enrolled in the credit monitoring service. Log into your account and navigate to the ¡°Credit Score¡± section under your profile. Here, you can view your current credit score, along with tips on how to improve it and monitor any changes over time. If you don¡¯t see this option, you may need to enroll in the service directly through the app or website.How do I reset my password in the Truist Mobile app?

Can I make mobile deposits using the Truist Mobile app?

Is there a limit on mobile deposits through the Truist Mobile app?

How can I enable biometric login for the Truist Mobile app?

What should I do if I encounter issues logging into the Truist Mobile app?

How can I view my transaction history in the Truist Mobile app?

Is it possible to transfer money between accounts using the Truist Mobile app?

Can I access my credit score through the Truist Mobile app?

Alternative Apps

- Chase Mobile: Chase Mobile App offers a similar range of features and benefits, allowing users to manage their Chase accounts, deposit checks, pay bills, and track investments. It is widely available to Chase customers and is known for its user-friendly interface and robust security measures.

- Bank of America Mobile Banking: Bank of America Mobile Banking App provides a comprehensive suite of banking services, including account management, bill payment, and mobile check deposit. It also offers features like card controls and alerts, making it a popular choice among Bank of America customers.

- Wells Fargo Mobile: Wells Fargo Mobile App enables users to access their Wells Fargo accounts, make transfers, pay bills, and deposit checks. It features advanced security measures, such as biometric authentication and real-time alerts, ensuring the safety of users’ financial information.

These apps, like the Truist Mobile App, offer convenient and secure banking experiences, empowering users to manage their finances with ease and flexibility.

Screenshots

|

|

|

|